It’s likely never been as important as it is now to use any and all strategies to age better. If the past 18 months has taught consumers anything, especially new converts to the supplements category, it’s that while many factors seem to be spinning out of control, we do have some control over our health. We can give ourselves every opportunity through healthy lifestyle choices, including supplementation, to be active, engaged and aware at the same time as we protect and nurture our joints, bones, heart and brain.

The subject of healthy aging has largely displaced anti-aging as a strategy and target market for supplement companies. While many view anti-aging as a fight against the inevitable, healthy aging really is about maintaining maximum functionality as the inevitability occurs. With that in mind, Industry Transparency Center’s ITC (Ingredient Transparency Center) team recently investigated consumer perceptions surrounding healthy aging in both the US and UK, asking these consumers what conditions were most frequently associated with healthy aging, and their supplement ingredients of choice.

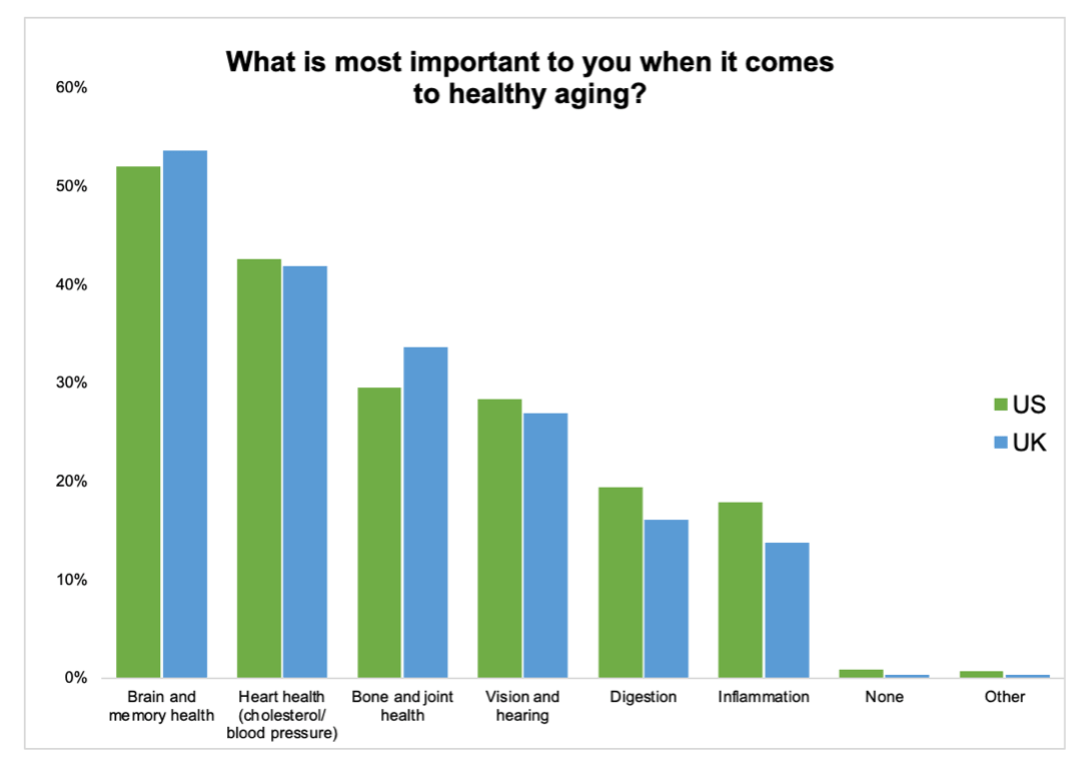

In both the US and UK, brain and memory health was the top stated concern, followed by cardiovascular concerns such as cholesterol and blood pressure then followed by bone and joint health. In fact, 57% of US females surveyed noted brain health as a concern, compared to 47% of US males, while in the UK those numbers were 58% and 49% respectively. For cardiovascular health the numbers were much closer together, with the US at 43% for both females and males, while in the UK, 41% if females and 43% of males listed cardiovascular health as a concern. Digging into age specific responses, 67% of US consumers, and an additional 59% of UK consumers surveyed were concerned about brain and memory health.

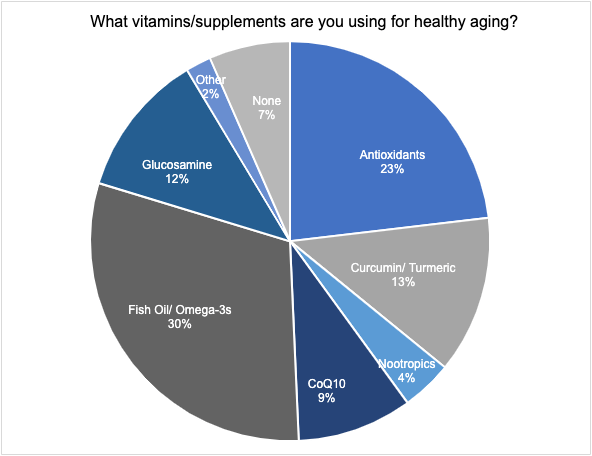

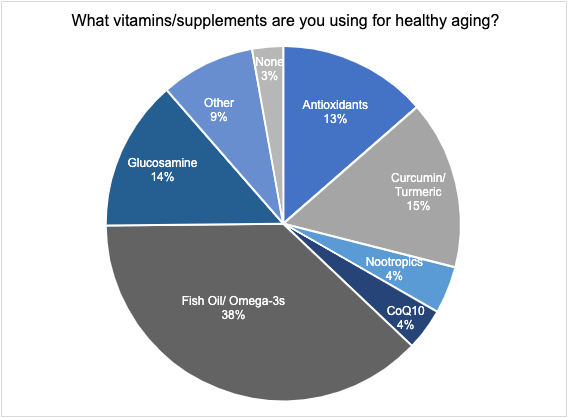

Separately (with a different pool of US and UK consumers), ITC asked about ingredients associated with healthy aging. Here the results diverged significantly with almost 40% of US consumers noting omega-3s and a further 30% selecting antioxidants as their healthy aging ingredient/category of choice. In the UK those numbers were 45% and 16% respectively with curcumin/turmeric in fact edging out antioxidants for the second highest response at 19%. Even glucosamine edged out antioxidants in the UK.

U.S.

U.K.

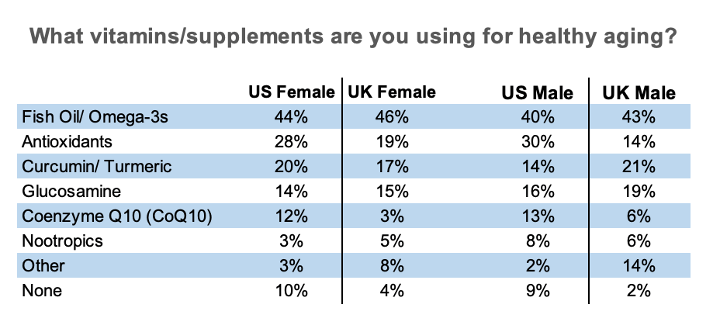

Taking a look by gender, we see relatively even gender splits in the both countries, with the exception of curcumin/turmeric and antioxidants. The former skews slightly female in the US (20% and 14%) while skewing male in the UK (21% vs. 17%). Antioxidants skew strongly female in the UK (19% vs. 14%) and slightly male in the US (30% vs. 28%).

Examining these results by age, we observe surprisingly consistent results for omega-3s in the US (between 36% and 47% – the latter at age 65 and up). In the UK, the range was certainly broader with 53% of those between the ages of 55 and 64 choosing that category. 40% of US consumers ages 25-34 selected antioxidants, and the low age group for that selection was 23% of those 18-24.

For curcumin/turmeric in the US was saw a range of 0% for those 18-24 to 21% of those 55-64. In the UK, both ingredients ranged from 12-22%, the high point for antioxidants being those 18-24, and for curcumin/turmeric, those ages 65+. Interestingly, in the US, over 27% of consumers 65+ selected curcumin/turmeric as an ingredient of choice, placing it second for that age group.

Healthy aging is a dynamic space with industry supplement opportunities especially in the brain cognitive area. On the ingredient side, broad recognition of ingredients on the one hand is positive. The curcumin/turmeric findings are surprising and bear further investigation.

Want to learn more? Register for Naturally Informed’s Healthy Aging: Mastering the Market virtual event on September 29-30, 2021.

~Len