Survey of US and UK consumers shows markedly different patterns

In today’s shopping universe, more consumers, especially supplement consumers, are going online than ever before. The demographics of online buyers are shifting too, with older consumers, especially during the pandemic, transferring much of their in-store buying. Combine that new reality with multiple personalized or targeted supplement options, better subscription and repurchase choices, and consolidated shopping trips (another pandemic behavioral shift). Shopping for dietary supplements has dramatically and irrevocably changed.

Over the past 20 years, the ratio of online sales to overall supplement sales has continually grown. Just over ten years ago, it made up 10% but was solidly outpacing the rest of the market, so when market growth was hovering at 4-6% overall, the 12-15% growth in online was transformative. Some data sources currently have online supplement sales pegged at 25% now, but industry experts believe this number might be understated by as much as 20% or more. A recently concluded Business Leaders Forum, conducted by NutraIngredients-USA, concluded that 2020 online sales doubled compared to the previous year.

In the United States, Amazon, followed by i-Herb and Vitacost, account for the bulk of e-commerce supplement sales, with individual brand websites also contributing to channel sales. Amazon also dominates other global markets, certainly the UK. Amazon has recently jarred the online supplement market by creating new rules for brands, including labels, testing, and documentation required. This is a step felt by many to be long overdue, even while others are criticizing the new rules as falling outside of regulatory requirements, being arbitrary, and not acknowledging testing expertise of the best brands and labs in the dietary supplements space. The fallout has been swift among e-tailing brands, with many Amazon dependent brands discovering for the first time some of their actual requirements under the law.

Sales online continue to grow. Many companies won’t survive the new Amazon criteria, and we’ll see a consolidation of the very fragmented marketplace. There are now ‘some’ barriers to entry, and , more prominent, credible brands will succeed. Will this impact trust online?

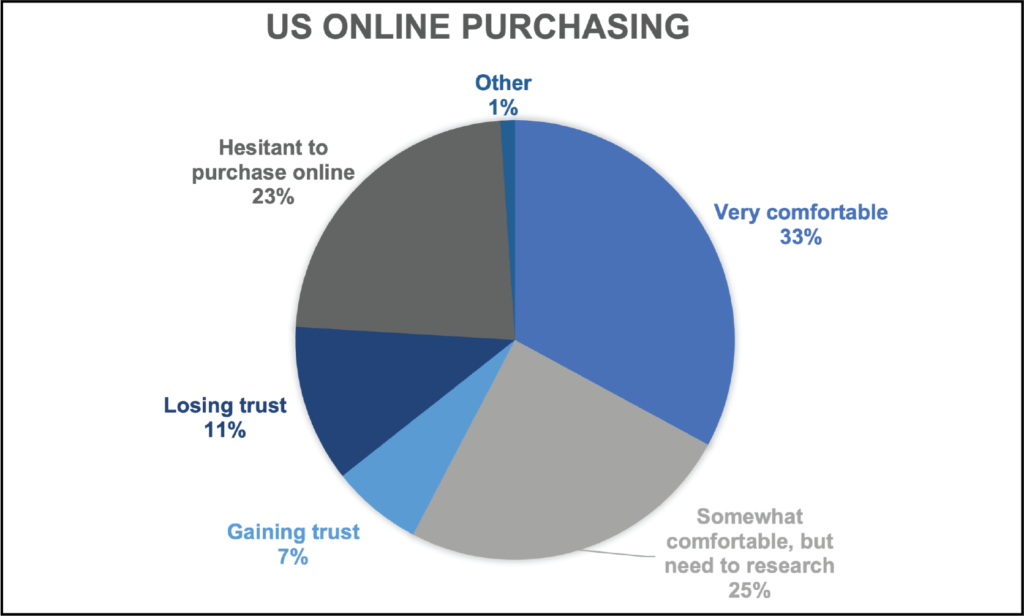

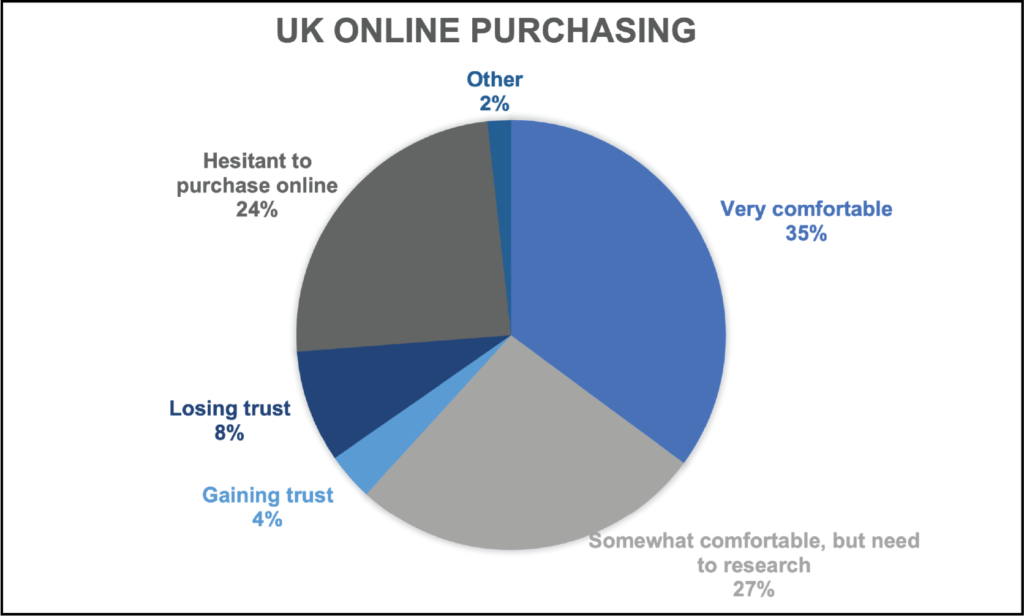

ITC’s Ingredient Transparency Center recently asked US and UK consumers about their trust in purchasing dietary (food) supplements online. While about half of all consumers said that they didn’t purchase any supplements online (45% in the US and 55% in the UK), of those that did, more consumers were very or somewhat comfortable and gaining trust (36% in the US and 30% in the UK) than were losing trust or hesitant to purchase online (19% in the US and 15% in the UK).

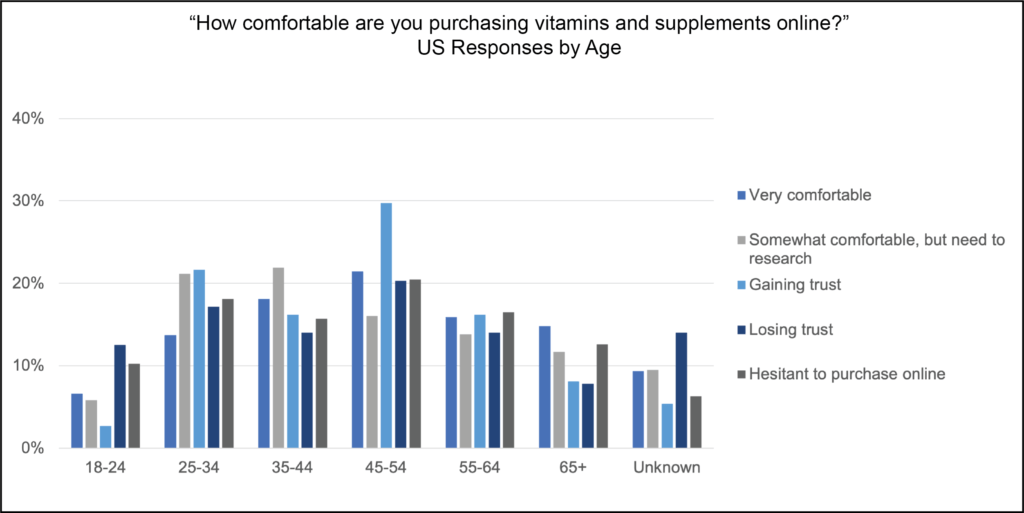

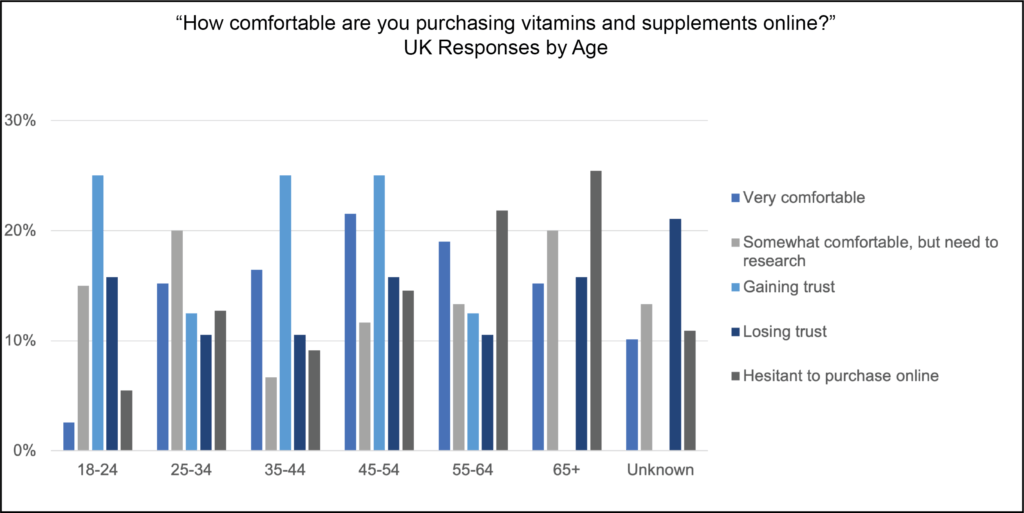

We then examined the age and gender differences and trust in online supplement purchasing. Here the big difference between the US and UK was the hesitancy to purchase online with 29% of males and 21% of females, of those that would buy supplements online in the UK, expressing reluctance, with the US at 20% of males and 28% of females with hesitancy – almost precisely the reverse.

By age in the US, surprisingly, the range of 55-64 showed the highest comfort and trust (40% very and 24% somewhat comfortable) followed by ages 35-44 (33% very and 30% somewhat) of those that do buy online, versus the UK where a slightly younger demographic (25-34) was very 33% or somewhat (33%) comfortable online. The 35-44 age group in the UK was the most confident, rating ‘very comfortable’ specifically higher (50% very and 15% somewhat comfortable). In the US, the youngest demographic, 18-24, indicated the highest level of hesitancy (31%). Conversely, in the UK, it was the >65 range, with 25%, that had the highest hesitation.

These results suggest that – trust in online buying generally skews younger in both countries but that the 35-44-year-old demographic in the UK, especially females, is a great driver of engagement and trust. In the US, the 55-64 range cannot be ignored and is a sure sign of the morphing of shopping patterns and behaviors.

These surveys are designed to shed light on consumer behavior, attitudes, and values relating to dietary supplements, health ingredients, and natural products.

If you have a burning question that you’d like to discuss with the ITC team, we’re happy to have that conversation. Contact us anytime.