We’ve talked about this before. Possibly the most opaque element of the dietary supplement supply chain is the contract manufacturer.

Arguably, contract manufacturers have the largest role in the production of a dietary supplement, but rarely are they identified to the consumer purchasing the product. Too frequently, consumer inquiries relating to manufacturing and manufacturers are met with a brand response of “that is proprietary information.” It is still standard practice for most brands to not disclose the name of their manufacturer to an inquiring consumer.

When Industry Transparency Center asked executives about this practice, responses have centered around the concern of competitors going to that manufacturer and reverse engineering their product.

This is not really a legitimate concern if they’ve got the right manufacturer in the first place. Consumers and retailers have a right to know where, and under what conditions a product is made. We expect increased demand for this transparency as our new normal leads to supply chain upheavals that can make product unavailable and workers increasingly obtain a voice that may in fact contribute to supply chain changes and disruption. Companies that do not exercise transparency in this environment are making a potential asset into a liability.

There are at least two hundred dietary supplement contract manufacturers in the United States, yet most of them have limited engagement with the rest of industry. This is manifest by lack of association involvement and poor engagement with groups such as the American Botanical Council and others providing benchmarking, education and practice guidance. Can you legitimately expect those that shirk these activities, refusing to engage with peers and experts to be the best and most compliant organizations to work with?

But, the U.S. FDA does spend a lot of time and resources on contract manufacturers. Most recently, it unveiled the FDA Data Dashboard, a tool that allows any user to see the inspection history between it and a manufacturer.

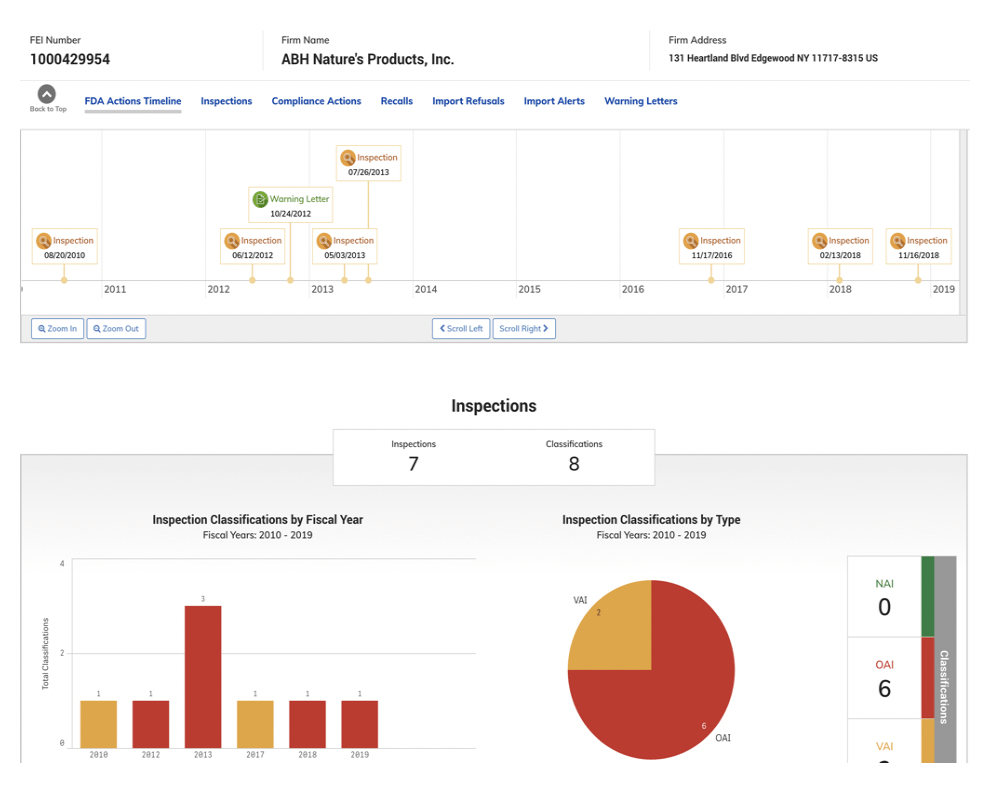

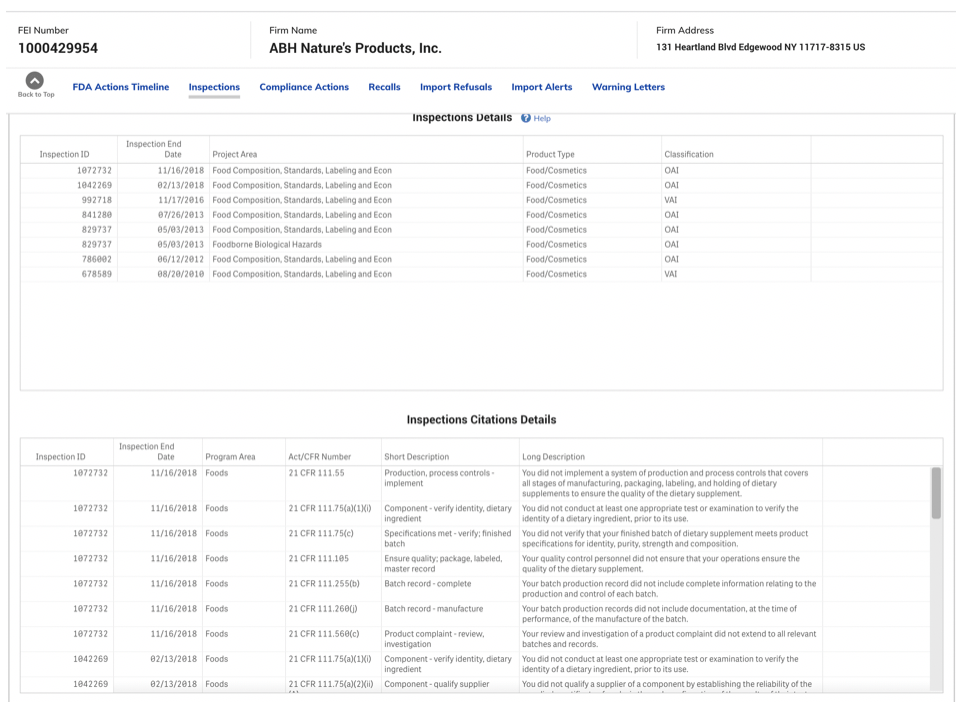

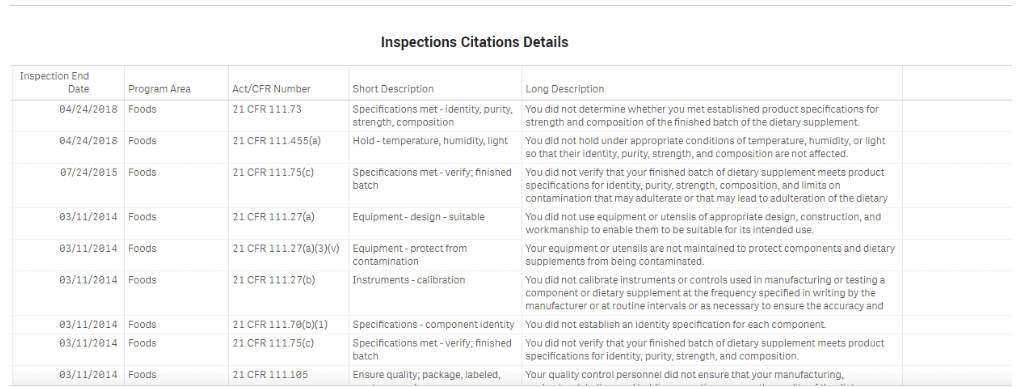

The most recent widely searched and discussed contract manufacturer is ABH Nature’s Products. The US Department of Justice in cooperation with the FDA recently implemented a recall of all products produced at ABH because of the firm’s refusal to take corrective action for violations referenced in seven inspections occurring over ten years [see below charts for detail.

In looking at all FDA’s inspection data from 2009-2019, FDA reportedly identified 1,105 violations requiring “Official Action” of Food/Cosmetics products, which is the category dietary supplement contract manufacturers reside within this database.

ABH was not alone in receiving repeated violations over several inspections. One CEO of a national brand, who we’ll allow to remain anonymous, was contacted in relation to this topic and we at ITC have advised him that his contract manufacturer is in a similar situation as ABH—case in point the data on the CM from the FDA dashboard.

ITC was told the brand was aware of the FDA cited deficiencies reported over the years. It has been realized, and presumably accepted in this case, that the CM was not following GMP as indicated by the numerous FDA inspections. In this case though, the brand chose not to change suppliers, and to simply provide postproduction third-party testing to ensure the purity and safety of the products produced – technically a fix.

However, even had ABH customers taken these same actions regarding post-production testing, the FDA would still have ordered its recall because the contract manufacturer is responsible for GMP compliance of its manufacturing operations. A workaround for those deficiencies is not a fundamental answer for compliance or best practices. This needs to change.

In analyzing the FDA database, ITC identified over 50 other contract manufacturers that have received three or more Official Action Indicated (OFI) citations from three or more inspections over recent years. Many of the FDA citations were repeated violations. Some of the companies have been closed by the FDA through injunctions – but not enough.

This database access is relatively new. The information contained in the database does reinforce the fact that many more contract manufacturers follow FDA cGMP than do not, and it calls out specifically those in violation. The database information allows for a greater degree of transparency into FDA inspections than has been provided previously, and any brand making a choice, and any retailer taking the gatekeeper role seriously should use this database to be more informed and potentially avoid an ABH type event in the future.

Key points to take away:

- It is your right, and it is best practice to ask about the inspection history of your supply chain partners and to audit them. Lack of clarity and transparency is a giveaway that something is likely wrong.

- Asking how suppliers, including contract manufacturers, are selected will provide huge insights into culture, compliance and commitment. Asking about the circumstances surrounding the last supplier that was ‘dumped’ is a good practice.

- The FDA Data Dashboard provides good intelligence and should be used as a risk management tool.

- Supply chain transparency and establishing trust along the chain is more than a risk management strategy. It should be used as an asset.

Related Articles & Resources