From Anti-Aging to Healthspan

From Anti-Aging to Healthspan: How Consumers Are Redefining Longevity

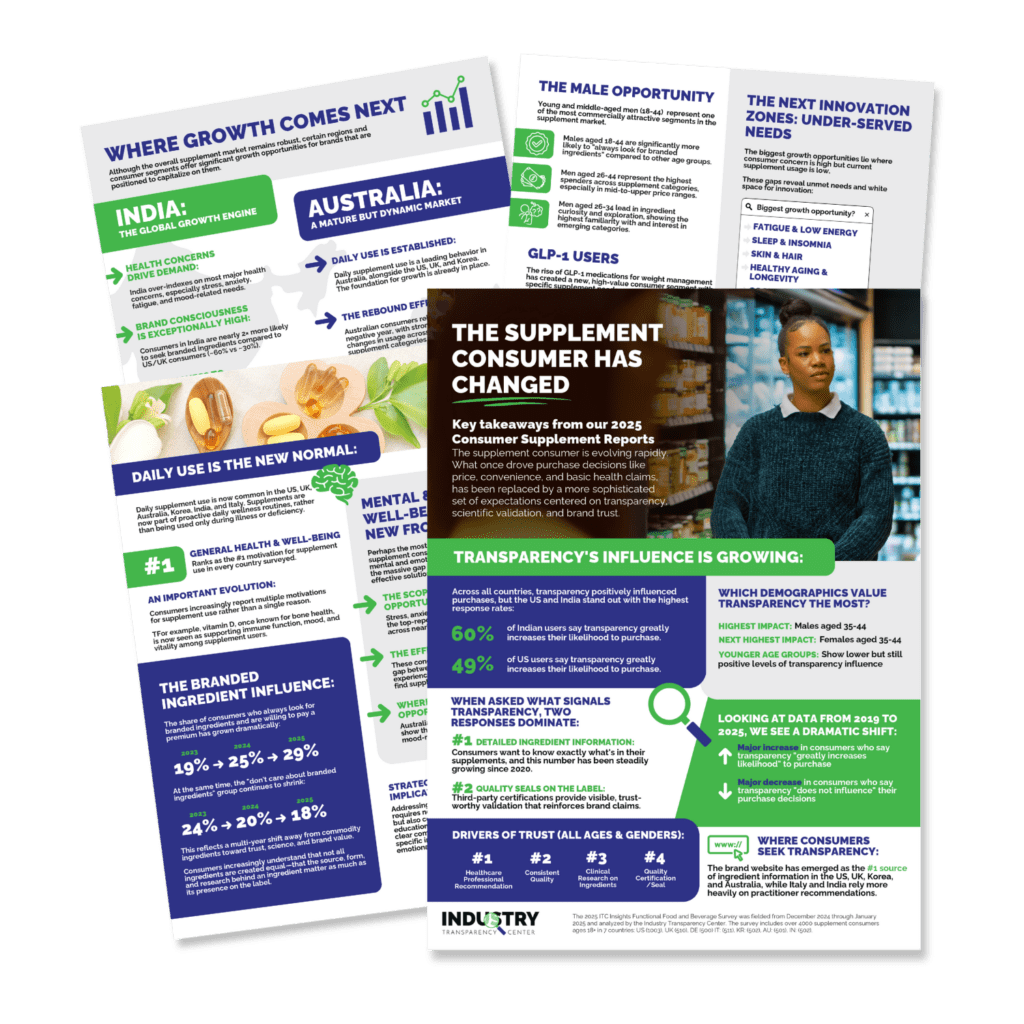

New data from the 2025 Consumer Supplement Survey reveals shifting priorities as active nutrition and cellular health take center stage.

The narrative around aging has fundamentally changed. Where consumers once sought to fight the visible signs of getting older, today’s supplement users are pursuing something far more ambitious: extending the years they feel vital, energetic, and fully engaged with life. This shift from anti-aging to healthspan represents one of the most significant evolutions in the natural products industry, and the data from Industry Transparency Center’s 2025 Consumer Supplement Survey shows just how profound this transformation has become.

All data below provided by ITC’s 2025 Consumer Supplement Report on Active Aging Users.

The Evolution of Aging Concerns

Over the past three decades, the industry has witnessed a remarkable progression. The 1990s and early 2000s were dominated by anti-aging messaging where consumers wanted to look younger, fight wrinkles, and turn back the clock. By the 2010s, the conversation matured into healthy aging and active aging, acknowledging that aging itself isn’t the enemy and starting to build the association between aging and being more active. Today, we’re entering the era of healthspan where the focus isn’t just on living longer, but on extending the years of healthy, functional living.

This evolution reflects more than changing marketing language, but a shift in consumer understanding of aging as a biological process that can be influenced and optimized. The data reveals that supplement users are no longer thinking about aging in isolated terms like joint health, energy, or cognitive function, but rather as an interconnected system where a whole systems biology approach is warranted, as new understandings about organ function and axes (gut brain, gut-lung, gut skin) and core systems remake the concept of wellness. Underlying principles too run deeper – cellular health impacts everything from physical performance to mental acuity.

The Hidden Gap: Where Concerns Meet Action

One of the most interesting findings from the survey centers on what we call “white space” or the “opportunity gap”; the space between consumers who have a health concern, those willing to take supplements for it, and those who actually do. This gap represents billions in untapped market potential.

Among the top health concerns, several show dramatic gaps. Anxiety and stress top the list of concerns, yet there’s significant distance between those experiencing these conditions and those currently taking supplements. Similarly, fatigue, insomnia, mood issues, and joint pain all demonstrate substantial white space between willingness to consume and actual consumption.

Even more revealing is the second tier of concerns. Healthy aging itself sits in this category alongside overweight/obesity, lack of mental energy, and eye fatigue. These represent clear education and awareness opportunities. Consumers recognize these concerns but haven’t yet connected them to potential supplement solutions. For brands and suppliers, this shows that the challenge isn’t always about creating demand, it’s often about demonstrating relevance, with education and clinical research being key tools to accomplish this.

Cognitive Health: The New Frontier

Perhaps the most striking pattern in the data involves cognitive health concerns. Memory issues, mood, lack of mental acuity, cognition, and focus all show enormous gaps between current consumption and willingness to try supplements. This cluster of concerns reveals that consumers increasingly view brain health as central to aging well, yet many haven’t found the right solutions.

This presents a significant opportunity for innovation in nootropics and cognitive support formulas. The market exists, consumers are concerned, and they’re willing to try solutions, but they need clearer pathways to understanding which ingredients work and why. Brands that can effectively communicate the science behind cognitive support while demonstrating real-world benefits will capture meaningful market share among more discerning and savvy consumers.

Trust and Transparency: The Foundation of Purchase Decisions

When it comes to building trust, healthcare professional recommendations remain the gold standard across the board, particularly for consumers 55 and older. However, the survey reveals that while older consumers prioritize professional endorsement, younger consumers, especially females 18-25 and females 26-34, show strong responses to clinical research on ingredients. In fact, a broader examination of the ITC data suggests that younger males are more likely to go deep into the research to convince themselves. Females, while intent on the research, will get it validated by their peers early in the process.

The transparency data offers another critical insight. Males aged 35-44 show the strongest response to transparency information at 68%, with males 26-34 and females 35-44 following at 57%. This suggests that transparency is more than just a feel-good marketing message, but a genuine purchase driver for specific demographic segments that brands can target strategically.

For branded ingredients, quality emerges as the most important value proposition, especially for consumers over 35. Close behind are established safety and trust, reflecting a market maturity where consumers are no longer simply looking for “natural” or “effective”, they want proof, safety data, and brands they can rely on.

Segmentation Reveals Different Motivations

The survey’s segmentation approach, dividing respondents into optimal aging, drivers of chronic disease, and active nutrition categories, reveals that different consumer groups prioritize different attributes when purchasing supplements.

The optimal aging segment shows muted responses overall, but “addresses my specific health concerns” remains strong, particularly for females of all ages and males 55+. This group also values clinical research on the ingredient more than healthcare professional recommendations, suggesting they’re more self-directed in their health decisions.

The drivers of chronic disease segment, by contrast, shows heightened concern across multiple attributes. They prioritize healthcare professional recommendations alongside specific health concern targeting. This group also shows elevated interest in online ratings and reviews, detailed ingredient information, and clinical research showing that they are researching thoroughly before making decisions.

The active nutrition segment demonstrates higher prioritization of addressing specific health concerns than professional recommendations. Clinical research on ingredients clearly skews toward older consumers and males in this segment, suggesting that athletic and active consumers want to understand the mechanism of action behind their supplements.

What This Means for Brands, Suppliers, and Manufacturers

For Brand Marketers

Education represents your primary opportunity, as the gap between concern and consumption reveals consumers who simply need to understand how supplements can help address their health goals. Content marketing, influencer partnerships, and professional endorsements that clearly explain the connection between ingredients and outcomes will be essential to driving conversion, as, of course, will be good clinical research supporting that easy to understand claim strategy. Beyond education, consider repositioning products around healthspan rather than isolated concerns-consumers are increasingly thinking inherently about, for instance, energy that powers both body and brain, and cellular health that impacts everything from skin to cognition. This holistic perspective means that single-benefit messaging may be leaving significant value on the table.

For Ingredient Suppliers

Investment in clinical research, particularly for cognitive health ingredients, has become essential, as the data clearly demonstrates consumer demand for this evidence. However, having the research isn’t enough; it must be presented clearly and accessibly, which means suppliers must partner strategically with brands to communicate findings in ways that resonate with end consumers. Increasingly, this is a key supplier differentiator. When it comes to branded ingredients specifically, quality and safety have emerged as the most critical value propositions, functioning not as differentiators but as baseline expectations that, when consistently met and effectively communicated, build the kind of lasting brand loyalty that drives long-term success.

For Manufacturers and Formulators

The cognitive health space for active aging users, represents a massive yet underserved opportunity, where formulas that thoughtfully combine proven nootropics with stress management and cellular health ingredients will capture consumers seeking comprehensive brain health support rather than isolated cognitive benefits. Given the distinct priorities revealed across consumer segments, there’s also a compelling case for developing segment-specific product lines rather than relying on one-size-fits-all formulations. The data makes it clear that optimal aging consumers, those focused on chronic disease prevention, and active nutrition enthusiasts each have different needs and decision-making criteria, suggesting that tailored approaches could unlock opportunities that generalized products inevitably miss.

Looking Forward

The shift from anti-aging to healthspan reflects consumers’ sophisticated understanding that aging well requires comprehensive, science-backed approaches to nutrition and supplementation. The gap between concern and consumption isn’t a market failure, but an invitation for brands, suppliers, and manufacturers to bridge this gap with education, transparency, and proven efficacy to capture the significant opportunity that lies ahead.

As consumers continue to redefine what it means to age well, the natural products industry has both the responsibility and the opportunity to meet them where they are, not with promises of eternal youth, but with tools to maximize health, function, and vitality throughout their entire lives. While the term ‘healthspan’ is not into the common language as of yet, its foundations truly are.

Filter by Category:

Want to dive deeper into the data?

Download our free Snapshot Report for additional insights and data visualizations, or explore the complete research findings with our 2025 Consumer Supplement Survey on healthy aging users.