Blog

Let’s face it. There’s no rule book for this current situation. We are experiencing unprecedented change in society across so many aspects of life and society. Behaviors are changing – with some of these changes likely to stick, others will be fleeting and give way to new norms, practices and habits. All data groups are digging deeply to get that crystal ball right, to determine which trends will prevail longer term.

During the past three months I have spoken with many business leaders in our industry discussing a disruptive yet strong March, in some cases a record-breaking April, and a strong May. While it is true that we have seen some flattening in some categories, in general, our supplement industry is being buoyed by a health halo that is expected to last for some time. In fact, Nutrition Business Journal has more than doubled its supplement sales forecasted growth for 2020—NBJ’s current forecast is 12.1% growth which is the most since 1997 when the dietary supplement industry was in its infancy.

We know for certain that lifestyles have changed. People have stayed home through lockdowns around the world, shopping and spending habits have shifted, concern for personal and family health has grown significantly. We would expect, therefore, to see the population consuming dietary (food) supplements to be increasing during this challenging time, right? Wouldn’t most people be taking more supplements and paying more attention? Sometimes, though, we forget that we live so close to those likeminded within the population that we have self-selected our close community with similar beliefs. If we poll our friends and colleagues, we’ll get a higher response rate, and that’s in fact what happened. Our internal poll showed almost 100% taking more or paying more attention. That led us to investigate more.

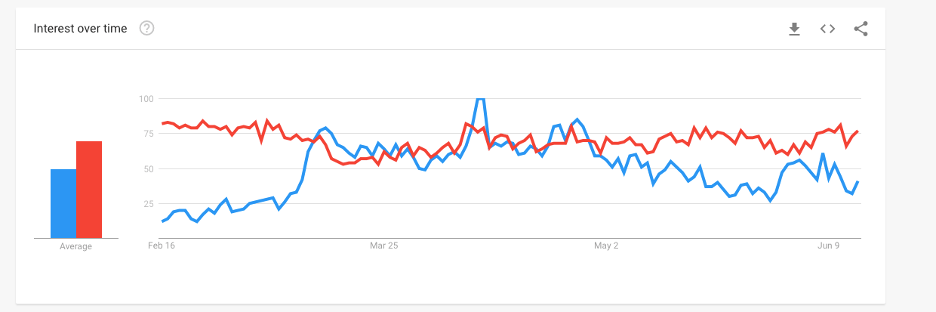

Trust Transparency started monitoring searches and behaviors in the US, and most recently, in the UK, regarding supplement consumption patterns. Figure 1 below is a snapshot over the past 3 months of google searches comparing the terms ‘supplements’ and ‘immunity’. It’s clear that supplements searches have remained steady throughout the past 3 months, while immunity searches spiked, then drifted lower, but are still oscillating around a higher average, presumably, we think, for the next few months as awareness of the association between immunity and wellness remains strong.

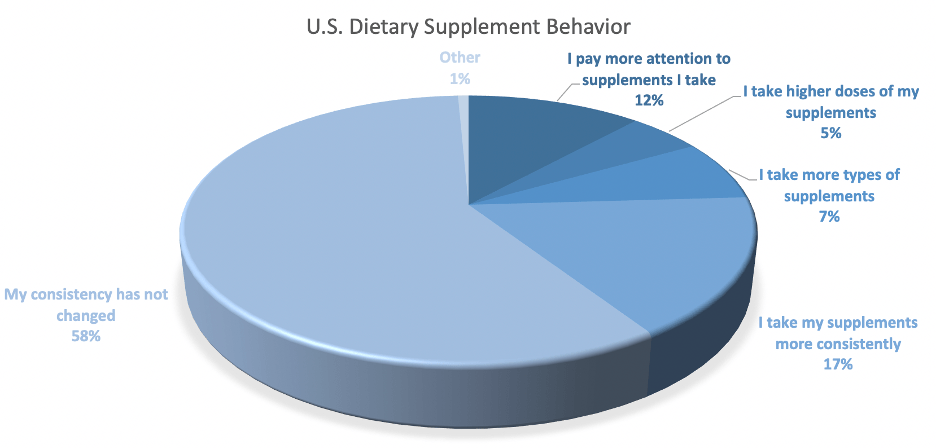

Also using Google, Industry Transparency Center conducted a survey a few weeks ago across consumers in both the UK and US, asking the question: “Which best describes your current behavior with regard to consuming dietary supplements?’ In both countries, between 55 and 60% of consumers stated that their consistency has not changed. On the flip side, this meant that 40 to 45% changed their behavior, in the US, 17% noting that they were taking supplements more consistently, followed by 12% observing that they were taking higher doses of their supplements. A further 7% took more supplements, with 5% taking higher doses.

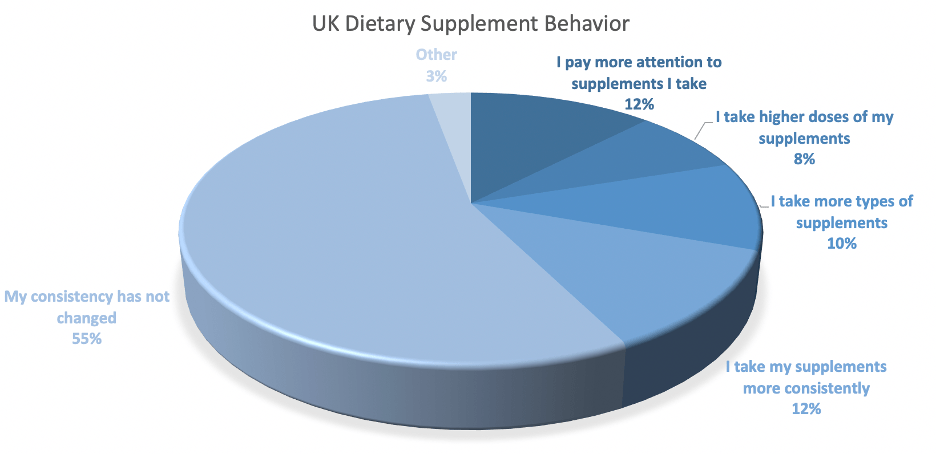

In the UK, 12% of consumers said they were taking their supplements more consistently, with an equal number describing taking higher doses. 10% of UK consumers said they were taking more supplements, with 8% describing taking higher doses.

These findings are significant, in that one of the challenges of generating increasing consumption has always been compliance; it should be no surprise that we are seeing some messaging reflecting this new observation and behavior. In the US females were twice as likely to report higher consistency, while in the UK, females and males were pretty much equal.

Predictably, younger respondents took more supplements or higher doses, in both the US and UK, with older demographics paying more attention to the supplements they took, rather than higher consumption levels.

It remains to be seen what sticks from current patterns of behavior. Things are changing weekly in so many actions and activities, and a huge unknown is the lasting effect of access to capital, disposable income, jobs and insurance. These factors will all play out across the various demographics, but a health halo is buoying our market, and for that reason, we are collectively doing better than we might. Many categories are seeing success, not only immunity with success in adaptogens, stress, sleep and other general wellness categories showing that much of the market creating diligence over the past decade plus has worked.

In the recession of a decade ago, dietary supplements out-performed many CPG categories. Although the current situation id dramatically different, history to some extent is repeating itself. The health halo appears to be real.

~Len