The GLP-1 Consumer Revolution

The GLP-1 Consumer Revolution: How Weight Management Medication Users Are Reshaping the Functional Food Market

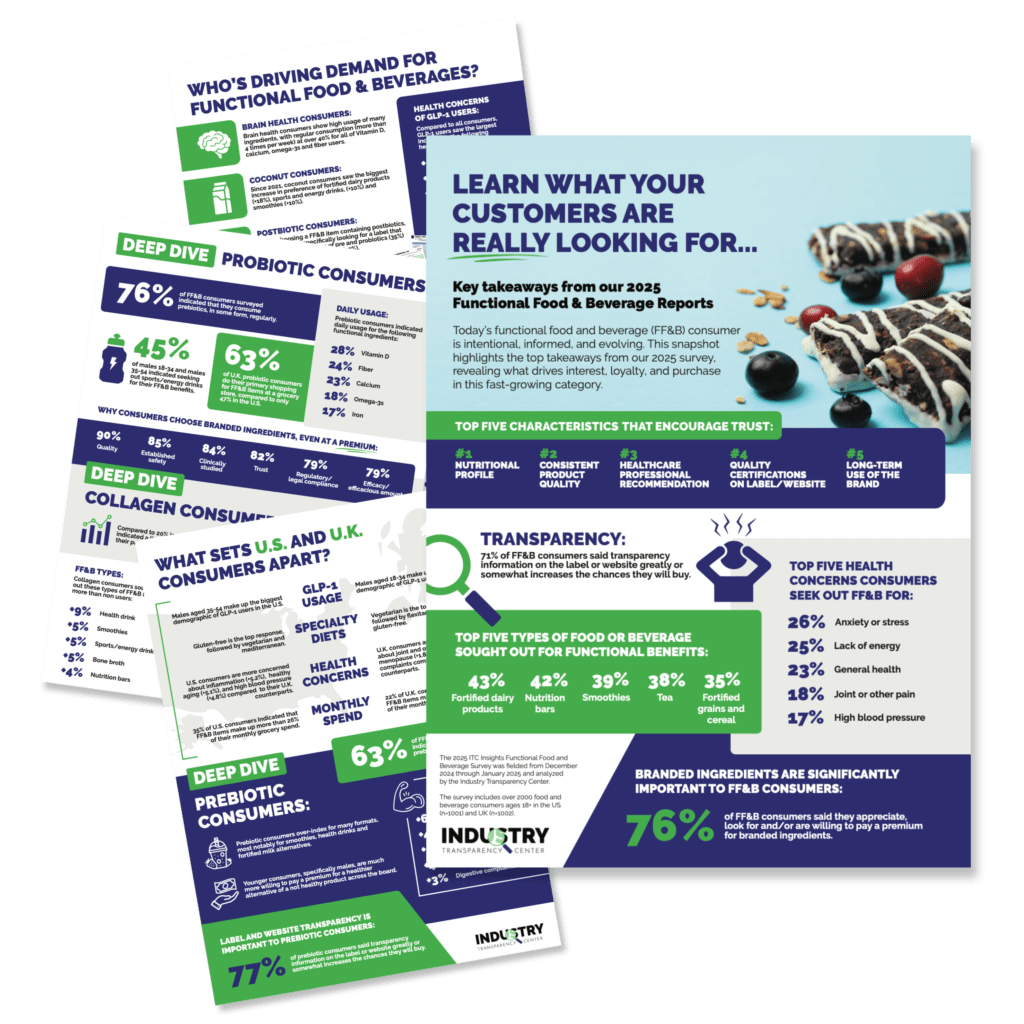

The rise of GLP-1 medications like Ozempic and Wegovy has created distinct consumer segments with unique nutritional needs and purchasing behaviors. For brands in the functional food and beverage space, understanding this rapidly growing demographic isn’t just an opportunity, it’s becoming essential for market relevance. The Industry Transparency Center’s latest research reveals how GLP-1 users are fundamentally different from traditional functional food consumers, creating both challenges and unprecedented opportunities for forward-thinking brands.

All data below provided by ITC’s 2025 Functional Food and Beverage Report.

A Premium Consumer Base with Higher Stakes

GLP-1 consumers represent a premium segment willing to invest significantly more in their nutritional choices. The data reveals these consumers consistently over-index in higher grocery spending categories, with males aged 35-54 leading as the biggest spenders across all categories above $500 monthly. More telling is their dedication to functional foods and beverages: GLP-1 users allocate a substantially higher percentage of their grocery budget to functional products, with the most dramatic differences appearing in the 26-50% and 51-75% spending ranges.

While this spending pattern reflects the broader GLP-1 user base, it particularly represents a motivated subset who are prime targets for functional foods and beverages. These consumers prioritize products that deliver protein and fiber in forms that are easier to digest and incorporate into their overall dietary strategy. It’s also important to note that GLP-1 consumers have distinctly different needs depending on their medication status.

When on medication, their goals center on hitting protein targets while maintaining fiber intake to manage common side effects like nausea and constipation. Both nutrients often require supplementation, since consuming enough through whole food sources becomes difficult due to reduced appetite. Easy-to-digest protein becomes essential when digestion is slowed, while gentle fibers and prebiotics are necessary to avoid feeling overly full and help prevent digestive complaints.

When transitioning off medication, these consumers face the challenge of returning to more solid protein and fiber sources. Functional foods and beverages continue to serve as valuable gap-fillers during this transition period, offering familiar, trusted nutrition solutions as appetite returns and eating patterns normalize.

The Trust Economy: Professional Influence Over Peer Recommendations

One of the most striking findings is where GLP-1 consumers seek nutritional guidance. Unlike general consumers who heavily rely on friends and family recommendations, GLP-1 users demonstrate a marked preference for seeking out and relying on professional advice when making decisions about diet and supplementation, including functional foods and beverages. They significantly over-index for licensed dietitians, medical doctors, and personal trainers while under-indexing for friends, family, and news/online media.

This professional orientation extends to their media consumption habits, where they show higher engagement with online influencers, likely those with credentialed expertise, rather than casual peer recommendations. For females aged 18-34, medical doctors rank as the top influence source, followed closely by licensed dietitians, indicating a generation that values both medical oversight and specialized nutrition knowledge.

Strategic Implications for Brands: This trust pattern creates clear pathways for product launches targeting GLP-1 users. The practitioner channel emerges as a critical distribution and education opportunity, and highlights the importance of prioritizing relationships with the broader integrative medicine community, such as RDs, nutritionists, and medical practitioners working in weight management. Additionally, influencer partnerships should focus on credentialed professionals rather than lifestyle and/or wellness influencers, emphasizing clinical expertise and evidence-based recommendations.

Selective Consumption: Quality Over Variety

GLP-1 consumers exhibit highly selective purchasing patterns that diverge significantly from general functional food buyers. While they significantly over-index for many popular formats, including health drinks, fortified milk alternatives, and indulgent functional foods like cookies and candy, they show more moderate preferences for specific categories: fortified dairy products, fortified grains and cereals, and tea.

This pattern suggests GLP-1 users are embracing a broader range of functional formats, possibly seeking convenient nutrition solutions that work within their medication regimen. The over-indexing for health drinks, a category popular among health-conscious consumers, indicates these users may be prioritizing liquid nutrition options that provide efficient nutrient delivery when solid food intake is reduced.

The Brand Loyalty Revolution: Premium Ingredients Command Premium Prices

Perhaps the most significant opportunity lies in GLP-1 consumers’ relationship with branded ingredients. A remarkable 45% of GLP-1 users actively seek branded ingredients and are willing to pay premiums—nearly double the 23% rate among all functional food consumers. This represents a fundamental shift in purchasing psychology where ingredient provenance and quality certification become primary decision factors.

The willingness to pay premiums extends across multiple categories when positioned as healthier alternatives, suggesting significant reformulation opportunities for brands willing to invest in premium ingredient sourcing and transparent labeling.

What This Means for Brands, Suppliers, and Manufacturers

For Brands: The GLP-1 consumer segment demands a complete reimagining of marketing strategies. Traditional peer-to-peer marketing gives way to healthcare practitioner partnerships and influencer collaborations with credentialed professionals. Product positioning should emphasize nutrient-dense and easy-to-digest formats, professional endorsements, and branded ingredient stories that signal transparency and efficacy.

For Suppliers: The emphasis on branded ingredients creates significant opportunities for ingredient suppliers to partner directly with consumer brands on co-marketing initiatives. GLP-1 consumers’ willingness to pay premiums for recognizable, quality ingredients suggests successful suppliers will find a return by leveraging consumer education and brand building beyond the B2B space.

For Manufacturers: The selective consumption patterns require strategic portfolio development centered on protein and fiber optimization rather than broad functional food lines. Success lies in developing products that address specific GLP-1 challenges: easy-to-digest protein formats, gentle fiber solutions for digestive management, and nutrient-dense options that work within reduced appetite constraints. This means fewer SKUs with higher functionality rather than casting a wide net across functional categories.

The Road Ahead: Precision Nutrition Meets Premium Positioning

GLP-1 consumers represent more than a trend, but another facet of how ‘precision nutrition’ can be implemented as a mainstream concept. Their purchasing behaviors indicate a market ready for products specifically designed around medication interactions, nutrient absorption optimization, and professional healthcare integration.

The convergence of higher spending power, professional influence networks, and selective consumption creates a unique market dynamic. Brands that can navigate the intersection of medical efficacy and consumer appeal, while building authentic relationships with healthcare professionals, will capture disproportionate value in this growing segment.

As GLP-1 medications become more accessible and the user base expands beyond current demographics, early movers in this space will establish the category standards and professional relationships that create lasting competitive advantages.

All data provided by ITC’s 2025 Function Food and Beverage Report.

Filter by Category:

Ready to dive deeper into the GLP-1 consumer opportunity?

Download our free snapshot report for additional insights and data visualizations, or explore the complete research findings with our comprehensive functional food and beverage report on GLP-1 users.

Understanding this consumer segment today positions your brand for tomorrow’s market realities!