Transparency Is the Key to Building Consumer Trust

Transparency Is the Key to Building Consumer Trust

The term ‘transparency’ is an operator at both ingredient and brand level. For the former, it means operating with integrity and best of class business values, being up front about issues that may impact brand clients, disclosing less than ideal news early and often and trying never to catch your clients by total surprise. At brand level, transparency tends to also include business values, but then there is a shift to the supply chain, sourcing and how that story is told. Whatever the case, transparency has never been more important, whether that is disclosing actual lab results, identifying a contract manufacturer or service provider, carefully crafting and telling the story of sourcing challenging ingredients or simply being up front about inventory management concerns.

Several years ago, the brand Gaia Herbs offered a ‘know your supplements’ program wherein viewers could log in by lot number and obtain quality and other batch documentation. Around the same time, e-tailer amazon disclosed the name of their house brand contract manufacturer, while Megafood offered transparency into their actual operations with a video camera. More recently, contract analytical lab Alkemist introduced ‘Alkemist Assured’, a transparency program at both ingredient and brand level disclosing detailed quality information.

What all their programs have in common, (and a few of the early ones have since ceased to exist as it turns out), is that they were intended to go far beyond what was absolutely required. In fact, one could say the same thing about some certification schemes – they call out what is already well known – these companies are leaders and elevate both because they can, but also they recognize that ultimately doing the right thing is a new positive to the operation and not simply an additional cost.

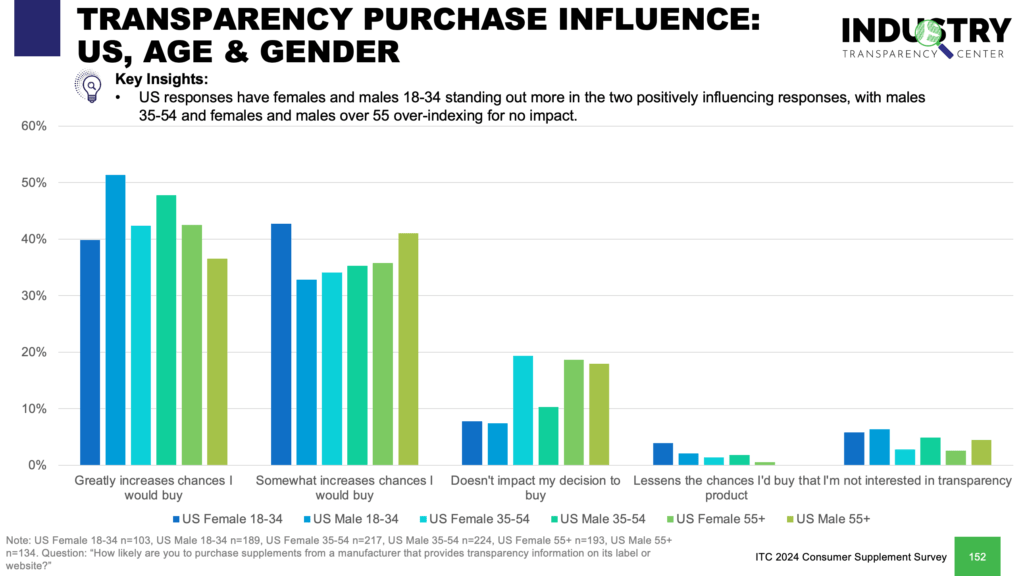

The Industry Transparency Center (ITC) consumer surveys have been measuring both trust and transparency in the market for years. As noted above, the importance of transparency has not diminished – it has grown – significantly, and this is a global trend. In fact, from the ITC 2024 supplement consumer data, across all US demographic sets, over 35% of each group says that transparency greatly impacts the purchase decision (the highest response is for males 18-34 followed by males 35-54), with an additional 32+% saying it somewhat increases the chances they will buy (topping out for females 18-34 at 42%).

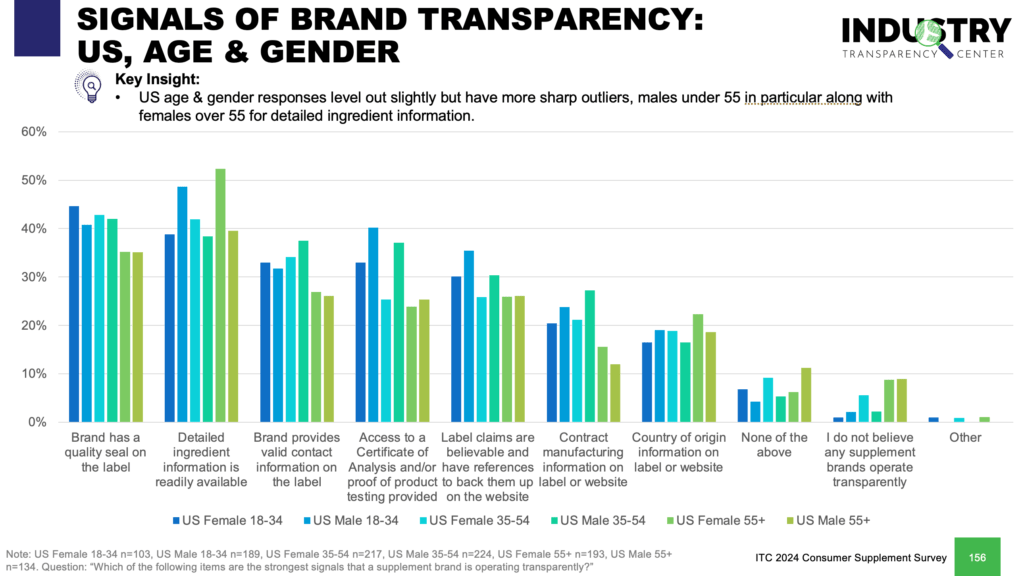

When we dig deeper into the specifics of brand transparency, we see a variety of attributes or signals that vary among demographic groups but are clearly led by quality seals and readily available detailed ingredient information. The latter tops out with both males 18-34 (48%) and females 55+ (52%). We see strong responses also for access to a Certificate of Analysis and/or proof of product testing.

It is evident that transparency at brand level is dependent on ingredient supplier transparency. The take home message here for suppliers is very obvious – maximize transparency. For brands, it goes two ways – first of all, demand and expect extreme transparency from your suppliers. Secondly, weave your supplier transparency details and stories into your brand story. Lastly, for retailers, influencers and other stakeholders – appreciate and call out transparency practices wherever possible. Consumers are seeking it and will pay a premium for it.

Filter by Category:

Recent Posts

- What Today’s Consumers Want from Functional Food and Beverage

- Effect of ashwagandha (Withania somnifera) extract with Sominone (Somin-On™) to improve memory in adults with mild cognitive impairment: A randomized, double-blind, placebo-controlled study

- Shilajit: A Natural Phytocomplex with Potential Procognitive Activity

- Kicking Off with Trends, Transparency and What’s Next

- India-America Boardroom Series: Episode One – William Hood