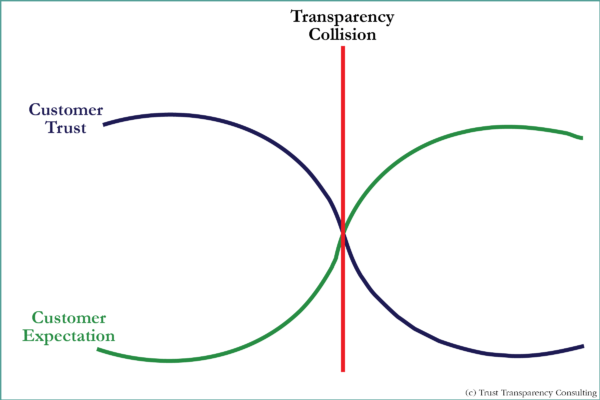

When expectations follow a trajectory different from reality it can be presumed a collision of trust and confidence will follow. Expectations of transparency by dietary supplement consumers and brand holders are increasing. Transparency of ingredient manufacturers in the dietary supplement industry is getting worse instead of better. Only multiple culture shifts will change the direction of an impending transparency collision. The problem exists inherently because ingredients are largely thought of as commodities and as such the origin and process of manufacture is less important. Ingredient quality is measured through testing rather than physical audits so only a snapshot of the ingredient at acquisition is assessed and the factors of process and production standards are often ignored. The relationship of awareness and interaction between ingredient manufacturers and ingredient purchasers has diminished instead of progressed over the past decade.

The expectation of transparency from the regulatory environment is also increasing yet the understanding from the ingredient manufacturers is not keeping up with the requirements. Few of the manufacturers are fully knowledgeable about the recent FSMA changes and the replacement of 21 CFR 110 with 21 CFR 117. Distributors and manufacturers alike are being held to a greater degree of responsibility with this replacement but progress of response has been slow to non-existent. The primary focus of the expanded replacement involves the application of the Hazard Analysis and Critical Control Points (“HACCP”) program previously applied to seafood, juice and retail/food and the FDA is now applying the program to the rest of the food industry including dietary supplements. 21 CFR 117 provides expansion of detail involving other sections of the previous part 110 as well as a creation of another set of record keeping requirements referenced as Hazard Analysis and Risk Based Preventative Controls “(HARPC)”.

The China Collision

This exercise of open collaboration is counter to what the consumer expects and what most brands portray. Consumers expect the highest quality standards possible for all elements of the products they purchase and certainly the ones they ingest. However, few brands perform the basic due diligence of verifying the authenticity of the manufacturer and instead rely on information provided through the distributor with little or no interaction with the actual manufacturer. Speak with almost any ingredient manufacturer in China and you find their knowledge of their customers is minimal and their interaction is similar. Physical audits by brand companies to ingredient manufacturers are typically relegated to a mere handful of companies.

Chinese manufacturers largely dominate ingredient manufacturing in the dietary supplement industry where a culture and opportunity for a less than transparent supply chain model is inherent and facilitated. Chinese ingredient manufacturers have historically relied on third party representation out of necessity and culture. Trading companies have been a staple for manufacturers of Chinese products dating back to the silk trade. The distributor “middle man” was, and is, necessary for overcoming obstacles such as culture, language and currency differentiations. Distributor driven marketing is not relegated to just the Chinese. There are exemplary Chinese companies that have made great strides to improve both communication to their customer and transparency of their process. It is not fair to say all Chinese ingredient manufacturers lack transparency nor is it just to singularly point to Chinese ingredient manufacturers as being the cause or culprits relating to decreased transparency. But, the sheer volume of the ingredients provided to the dietary supplement industry, as well as the language, communication and supply chain challenges make the problem exponentially larger than other geographies or cultures.

The historic and current supply chain model by Chinese ingredient manufacturers further complicates the issue. Fifteen years ago the shift from western manufacturing sources to Chinese manufacturing sources began to occur at a rapid rate. At that same time federal regulations and requirements of brand holders began to increase. Additionally, with the advent of internet research, the consumer has increasingly become more demanding of product quality, responsibility and transparency. When ingredient manufacturing was largely European and United States based interaction and knowledge of manufacturer identity was less of an issue. United States Supreme Court Justice Louis Brandeis stated “Sunshine is the best disinfectant” referencing publicity and transparency. Bringing light to the issue of transparency from ingredient manufacturers is not only a good thing to do; it is the right thing to do. The ingredient manufacturers are not purposefully hiding but the trend of transparency is not lending itself to a solution emanating from anywhere but request. The action of transparency needs to be a two-way affair but the initiation of action and dialogue must occur with the party that understands the necessity of the conversation the most, which is not the ingredient manufacturer.

The transparency collision at risk is not a Chinese problem or one that is the fault of the Chinese ingredient manufacturers; it is an industry problem allowed to exist because of the industry’s evolution and consumer idealism.

The transparency collision in the dietary supplement industry can be avoided. Failure of effort and attention to this subject will undoubtedly allow the issue of transparency to simmer until it boils. The transparency collision can come from newly implemented FSMA actions, consumer group investigations or a variety of other sources. The transparency collision can be avoided by a more aggressive effort by all sides of the equation.

~Scott Steinford, Managing Partner, Trust Transparency Consulting